[339] Creating safe assets, stripping banks of power to create money

328 views

Description

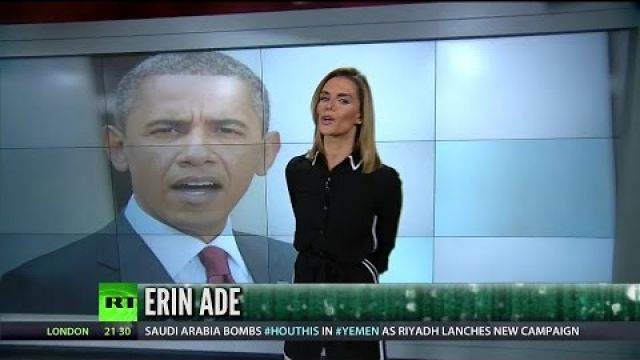

This week, President Obama laid out the case for his expansive trade agenda known as the Trans Pacific Partnership (TPP) agreement. However, members of his own party were the ones providing the pushback, saying that the trade pact is a bad deal for American workers. Labor unions have been...

This week, President Obama laid out the case for his expansive trade agenda known as the Trans Pacific Partnership (TPP) agreement. However, members of his own party were the ones providing the pushback, saying that the trade pact is a bad deal for American workers. Labor unions have been particularly vocal about the downsides of TPP, hosting protests and rallies. Erin weighs in. Then, Erin is joined by David Beckworth – assistant professor of economics at Western Kentucky University and adjunct scholar at the Cato Institute. David gives us his take on a recent paper by the IMF that argues there’s not enough public debt is safe asset economics and tells us is the US and Germany would need to expand fiscal policy if they issued more safe assets. After the break, Bianca gives us a daily news update on other major business headlines including US oil production, Tesco, and Yahoo! Japan. Afterwards, Erin sits down with Victor Matheson – professor of economics at College of the Holy Cross. Victor tells us how the increase in NHL revenue will affect the currency salary cap and gives us his take if the salary cap introduced in 2005 has been successful. And in The Big Deal, Erin and Edward discuss Iceland’s radical money plans. Take a look! Check us out on Facebook -- and feel free to ask us questions: http://www.facebook.com/BoomBustRT http://www.facebook.com/harrison.writedowns http://www.facebook.com/erinade2020 Follow us @ http://twitter.com/ErinAde http://twitter.com/edwardnh