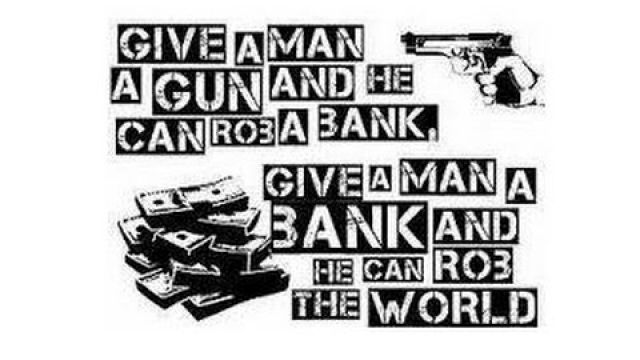

"CENTRAL BANKTERS" ROBBING THE "ENTIRE WORLD"!

175 views

Description

The Fed’s latest statement, was mainly just another trite economic weather report which could have been written after watching CNBC with the sound turned off.. But the statement did hint that maybe 78 months of ZIRP won’t be enough, after all. Having stripped out all calendar references relative...

The Fed’s latest statement, was mainly just another trite economic weather report which could have been written after watching CNBC with the sound turned off.. But the statement did hint that maybe 78 months of ZIRP won’t be enough, after all. Having stripped out all calendar references relative to the timing of its upcoming monetary body slam, whereupon Wall Street gamblers will be be charged the apparently usurious sum of 25 bps for their poker chips, it hinted at another reason for delaying the dreaded day: "To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation".. So if they don’t see enough inflation soon, they will keep Wall Street rampaging at the zero bound even beyond June 2015.. The very same Keynesian economists who insisted that the oil price collapse would cause consumer spending to surge are now urging the Fed to delay raising rates because inflation is too low and the US economy has once again stalled-out.. There just plain ain’t no deflation crisis, nor any change of CPI trend other than the oil plunge, which ironically was caused by the central banks themselves.. They accomplished this, first, by inflating a global boom that exaggerated the sustainable demand for oil; and then by generating a panicked scramble for yield among money mangers that led to $500 billion of cheap debt flowing down the well bores in the shale patch, and a resulting flood of excess supply on the world petroleum market.. So what the Fed is doing is simply further inflating the financial bubble on the self-serving theory that asset inflation doesn’t count. Well, it seems that the Fed’s “maximum employment” objective was bushwhacked by the 2008 bubble meltdown on Wall Street and the Great Recession which followed.. Yet the inhabitants of the Eccles Building stubbornly insist that there are no worrisome bubbles yet evident.. Well, here’s one from Janet Yellen’s own backyard courtesy of Dr. Housing Bubble. The median house price in San Francisco is now $1.1 million, and it has been stair-stepping higher like clockwork during each of the Fed’s QE money printing phases.. Indeed, if you had been idling your time in a median priced condo in San Francisco for the past 48 months you could have cashed out this winter at a 72% gain. That’s a $462,000 profit for standing around the basket during the Fed’s monumental money printing campaign.. And yet this is about much more than windfalls to existing property owners who have been smart enough to sell before the next crash. The insane appreciation shown below is only symptomatic of what is happening in the entire US economy.. That is to say, for every instance of windfall gains there are associated disruptions, deformations and malinvestments that reduce societal equity today and generate dead-weight economic losses tomorrow.. That’s what bubbles do, and San Francisco has proved that more than once in the present era of central bank driven financial inflation..There is no mystery, of course, as to where the buying power that propelled this price explosion came from. San Francisco is ground zero for the social media and biotech bubbles.. The cascades of cash which have tumbled out of these bubbles are mind-boggling. The billions of venture capital flowing into these sectors support booming start-up payrolls, mushrooming networks of vendor support services and prodigious on-line advertising outlays. The latter generate more of the same in the next tier of startups which burn the advertising revenues that were funded by their “advertising customers” VC cash. And when this pipeline of start-ups is eventually pushed into the delirious IPO markets, the brokerage accounts of the selling entrepreneurs are suddenly flush with cash and stock—-all the better to collateralize jumbo loans to buy condos, townhouses and lofts and renovate them in style.. Needless to say, this is not capitalist creation at work—–even though venture capital risk-taking and homeruns for inventors and innovators are the sum and substance of real prosperity and growth. What is wrong here is not the process or even some of the outcomes likes Apple and Google.. The evil lies in the context in which today’s venture capitalism is being played out. Namely, an artificial financial casino fostered by central bank falsification of prices and valuations—a milieu where blind greed and mindless start-up activity run wild without the disciplining forces of honest and free capital markets...

Sqwatchy2

Sqwatchy2